Life Insurance

Click here for a quick life insurance quote tailored to you!

Why do I need life insurance?

Should you pass away life insurance is intended to provide financial aid to your loved ones, which may include funeral expenses, as well as debts and other expenses. The loss of a loved one is a difficult time emotionally; however, unfortunately it can also present a financial burden as well. Life insurance may help your family pay the mortgage on your home, maintain their current standard of living and/or fund future expenses such as a child’s education.

When should I consider purchasing life insurance?

No matter your age, marital status or number of dependents, life insurance can benefit individuals at various stages of life. While life events such as the birth of a child may trigger the thought of purchasing life insurance, it’s often better to purchase a policy sooner rather than later.

Why purchase life insurance?

The three most common reasons to consider purchasing life insurance:

- Eliminate debt for a surviving spouse. This may include a home mortgage, as well as other debts such as school loans, etc.

- Provide for a child or children and their future(s), including but not limited to living expenses, education, etc.

- Income replacement, which refers to leaving surviving family with adequate financials to support their living conditions, assuming your income is necessary for them to maintain their current lifestyle, as well as their future.

How much life insurance do I need?

To best determine an appropriate amount of life insurance for any individual it’s common to consider the above mentioned items:

- Any debts a surviving spouse may be left to pay such as a mortgage, student loans, etc.

- The cost of living for surviving family members, which may include daily expenses such as cost of living, household expenses, education, etc.

While there is no set recommended amount for individuals of a certain age, gender, marital status, etc., considering the above mentioned items on an individual basis is the best method for determining an adequate amount of life insurance coverage.

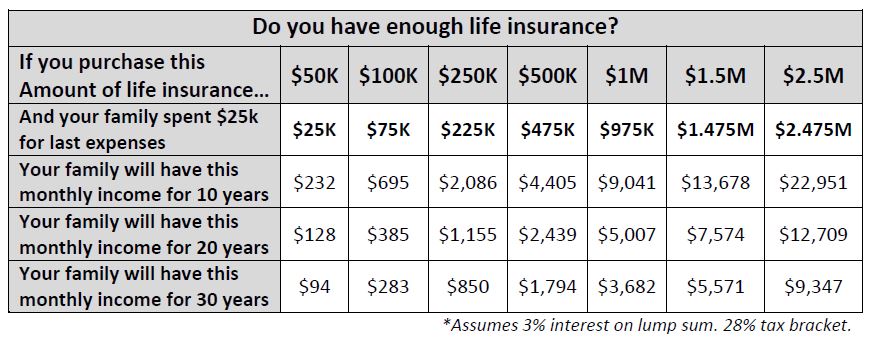

To provide a general idea of how much coverage a life insurance policy may provide over a given period of time, consider the following scenario. Assume your family spends $25,000 for last expenses, a term often used to refer to funeral expenses, possible hospital/medical bills, etc. The remainder of the life insurance policy is shown below. Depending on the amount of coverage purchased, a breakdown is given assuming the finances are to last 10, 20 or 30 years.