Yes, it’s April 1st but don’t be fooled!

If you’ve ever heard “Be your own advocate!†when it comes to health care, or ever been in a situation where that would apply… you know how true it is. Things are happening in health care. Big things. And while some of them are huge innovations, strides with technology and more knowledge than medical professionals ever dreamed of… there’s still a bit of a dark side that the average consumer needs to be aware of. Billing. Womp womp.

Now before this gets misconstrued as a negative connotation of doctors, nurses, hospitals or anything else specific to the medical world, we are not by any means speaking generally or negatively about all things health-related. This is simply a warning to patients to pay attention.

Here are some quick stats from a healthline study to ensure that we are providing facts rather than opinions on this:

- Up to 80% of medical bills have errors

- Nearly 1/3 of Americans learn that their health insurance doesn’t pay what they expected

- 59% of the time Americans are contacted by debt collectors is for an outstanding medical bill

- 16% of Americans’ credit report includes medical debt totaling over $80 billion

Instead of pointing the finger at medical professionals or facilities for over charging, let’s discuss a few ways you can prevent being on the receiving end of those not so fun surprise charges:

- Speak up. If you don’t understand a procedure, diagnosis, treatment plan or medication, find your voice and use it. Ask questions. Make notes. Do some research. You know your phone is close by, look it up online and educate yourself. Yes, you should trust the licensed and very well educated professional that spent a lot of time in school to do this for a living but understand what they’re telling you and be sure you’re on board.

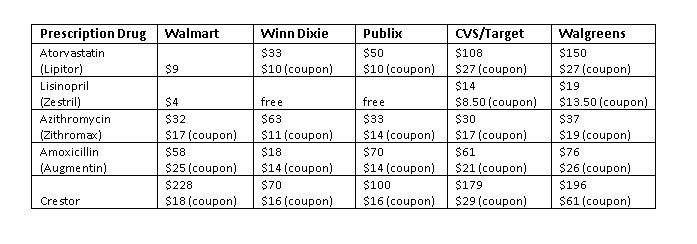

- Price shop. Find out if certain facilities perform procedures for less and why. This is common with teaching hospitals. This also applies heavily to prescription drugs. Don’t just use the pharmacy closest to your house because it’s convenient and they have a drive-thru. Look at goodrx.com or call around to others to see what their cost is. Now obviously, keep in mind that if you have health insurance, there may be certain pharmacies they work with or providers that are in or out of their network. But don’t just default to the most popular or most convenient. Your wallet will thank you.

- Request details. Ask for an itemized bill/Explanation of Benefits. Keep documentation for your records. Don’t just pay whatever you’re told without knowing what exactly it’s for.

- Channel that feisty preteen 7th grader in debate class that we know is still in you and fight for yourself. It might amaze you at how much health care providers are willing to negotiate if you can come to an agreement of either a payment plan, pay in full discount or overall reduction if it can be justified.

Your health is not a game and you can’t put a price on a medical necessity… so you should by all means get the best care possible. However, a little awareness and self-advocacy can go a long way and may even help facilitate a more proactive approach to good health… now that you’ll be able to afford it.